do nonprofits pay taxes on donations

Here we break down what tax deductible means and how you can use it to your advantage. When a donation is a gift gift taxes may apply -- but the recipient does not have to pay them.

Fundraiser Donation Request Letter Donation Letter Donation Letter Template Fundraising Letter

Donations to nonprofit organizations are not taxable PROVIDED the donation does not result in the granting of admission to an event or place.

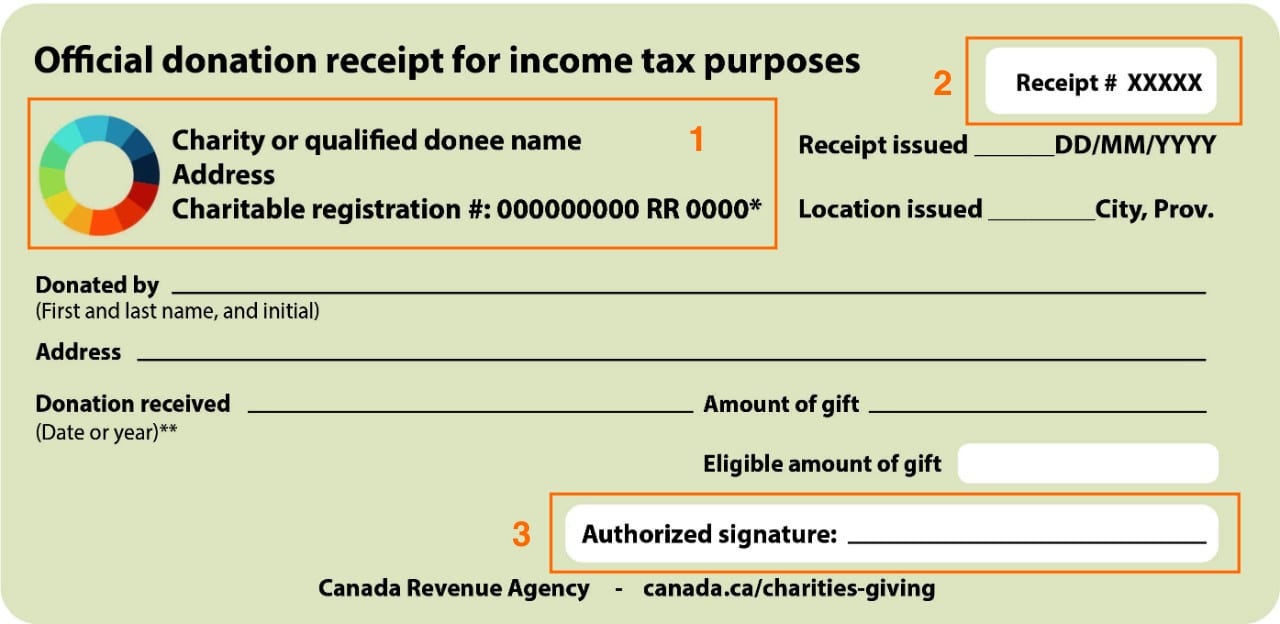

. As nonprofit organizations raise funds and solicit donations tracking and properly recording monetary contributions becomes an important function as donors require detailed receipts to claim tax deductions. You may not use an Exemption Certificate purchasing promotional. One of the best ways you can encourage people to donate to your non-profit organization is by assuring them that their donation is tax-deductible.

So the first umbrella income related to your exempt purpose is relatively simple. Persons who donate goods to nonprofit charitable organizations or state or local government entities are exempt from use tax if they have had no intervening use of the goods. There are many circumstances in which a nonprofit is required to pay or collect sales tax on a particular transaction or in general.

State and local property taxes state income tax and sales tax on purchases. If you want to schedule an event to raise money publicize this fact as it may be an excellent way to draw in donors. In both cases sales tax requirements might exist despite a general IRS exemption.

They also may be exempt from paying state sales tax on their purchases and from local property tax on property they use to carry out their charitable activities. Donations are tax-deductible for donors. Recipients do not report them on their taxes.

Tracking nonprofit donations. How donors charities and tax professionals must report non-cash charitable contributions. Amount and types of deductible contributions what records to keep and how to report contributions.

For the 2021 tax year you can deduct up to 300 per person rather than per tax return meaning a married couple filing jointly could deduct up to 600 of donations without having to itemize. However this corporate status does not automatically grant. How do we purchase promotional items that we give to donors in return for their donations.

You will pay the Sales and Use Tax to your supplier for purchases of taxable promotional items because your organization is regarded as the final consumer of the items it gives away. The extent and nature of exemptions from state taxes will vary from state to state. View solution in original post.

A searchable database of organizations eligible to receive tax-deductible charitable contributions. The biggest thing to remember is that nonprofits will not be paying out profits which is why they are called nonprofits in the first place. Charities generally do not pay state or federal income tax.

Gift taxes are the responsibility of the person giving the gift. Donations are a critical piece of nonprofit accounting basics. Also donors may be able to take a tax deduction for their donations to these organizations.

However items withdrawn from resale inventory and donated to organizations such as nonprofit museums art galleries and libraries are not taxable. Deductions which may include bank interest and donations gift aid can be re-stated as a result. State tax exempt benefits vary by state but most include.

Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces. In general a person can give any individual a certain amount each year without triggering gift tax. Do i need to pay tax on donations that were given to me.

Several different kinds of taxes may apply to your business activities. The IRS categorizes crypto as property which means taxes on crypto donations are treated the same as donations of stocks with lower tax rates than US. A similar anecdote applies to individuals so long as you donate less than 15000 you dont have to pay the gift tax or report anything to the IRS.

As of 2014 that amount was 14000. Many nonprofits are exempt from most federal income taxes and some state taxes such as sales and property taxes. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Do charities pay taxes. Nonprofit organizations are increasingly accepting Bitcoin and other cryptocurrency donations because of the favorable taxes and fees. Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations.

For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company. Generally donations of gift cards gift certificates checks cash or services are not subject to tax since there is not an exchange of merchandise or goods.

Or the provision of a taxable service such as pest control or building cleaning see the List of Taxable Services guide for additional. The transfer of property such as a meal cap book etc. A hardware store donates an industrial pressure washer to a nonprofit community center for neighborhood cleanup.

23 hours agoAccording to the IRS charities do not have to pay tax on many forms of income as long as they use the money for charitable purposes.

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budget Spreadsheet Budgeting

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Complete Guide To Donation Receipts For Nonprofits

What Is The Difference Between Nonprofit And Tax Exempt Nonprofit Startup Start A Non Profit Non Profit

Donation Receipt Template Receipt Template Receipt School Fundraisers

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Grant Writing

Difference Between Charity Business Administration Think Tank

Paypal Nonprofit Donation Fees In 2021 It S Alternatives Donorbox

40 Donation Receipt Templates Letters Goodwill Non Profit Donation Letter Template Donation Letter Receipt Template

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

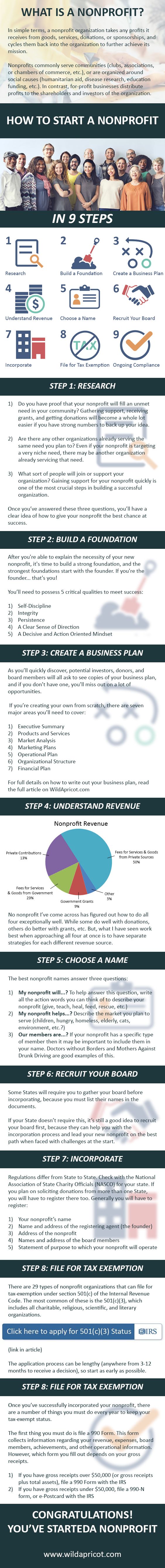

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Professional Nonprofit Operating Budget Template Word Example Budget Template Donation Letter Template Budgeting

Fundraising Infographic Fundraising Infographic A Brief History Of Charitable Giving Visual Ly Charitable Giving Infographic Charitable

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

40 Donation Receipt Templates Letters Goodwill Non Profit Donation Letter Template Donation Letter Receipt Template

Donation Receipts Statements A Nonprofit Guide Including Templates

Complete Guide To Donation Receipts For Nonprofits

How Nonprofits Can Attract Corporate Sponsorships Charity Work Ideas Fundraising Nonprofit Fundraising

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)